CMS has officially released the entire slate of performance feedback, final scores, and payment adjustments for the 2022 Performance Year/ 2024 Payment Year. It’s imperative for all those who participated in MIPS last year to view this feedback, as you will have until October 9, 2023 at 8:00pm to request a targeted review to address any potential errors that may need correction.

How to View Feedback

You can view your PY22 feedback at the Quality Payment Program (QPP) website. You must sign in with your Health Care Quality Information Systems (HCQIS) Access Roles and Profile (HARP) system credentials. Click “View Feedback” on the home page and select your organization. Included in the performance feedback is the following:

- Performance category-level scores and weights

- Bonus points

- Measure-level performance data and scores

- Activity-level scores

- Payment adjustment information

- Patient-level reports

What Makes up My Final Score

Your MIPS score is a combination of performance scores and any extra points you earn for treating complex patients. If you’re associated with multiple groups/practices, CMS ensures you receive the best possible score, determined by your TIN/NPI combination.

Additionally, your final score card will indicate which reporting framework the score is based on – traditional MIPS or the APP. In PY 2022, the Cost category accounted for 30% of your MIPS score, but only if you qualified for at least one Cost measure. If you didn’t, the weight from the Cost category was shifted to another category.

If you meet specific requirements, CMS provides detailed patient-level reports, offering a deeper understanding of your scores. Changes were made in how bonuses for treating complex patients were calculated: only certain clinicians or groups with a set risk indicator now qualify for this bonus.

Furthermore, there’s potential to increase your Quality performance score by up to 10% if you show improvements from the previous year. Lastly, for 2022, facility-based scoring was not available in the MIPS assessment.

Calculation of Payment Adjustment

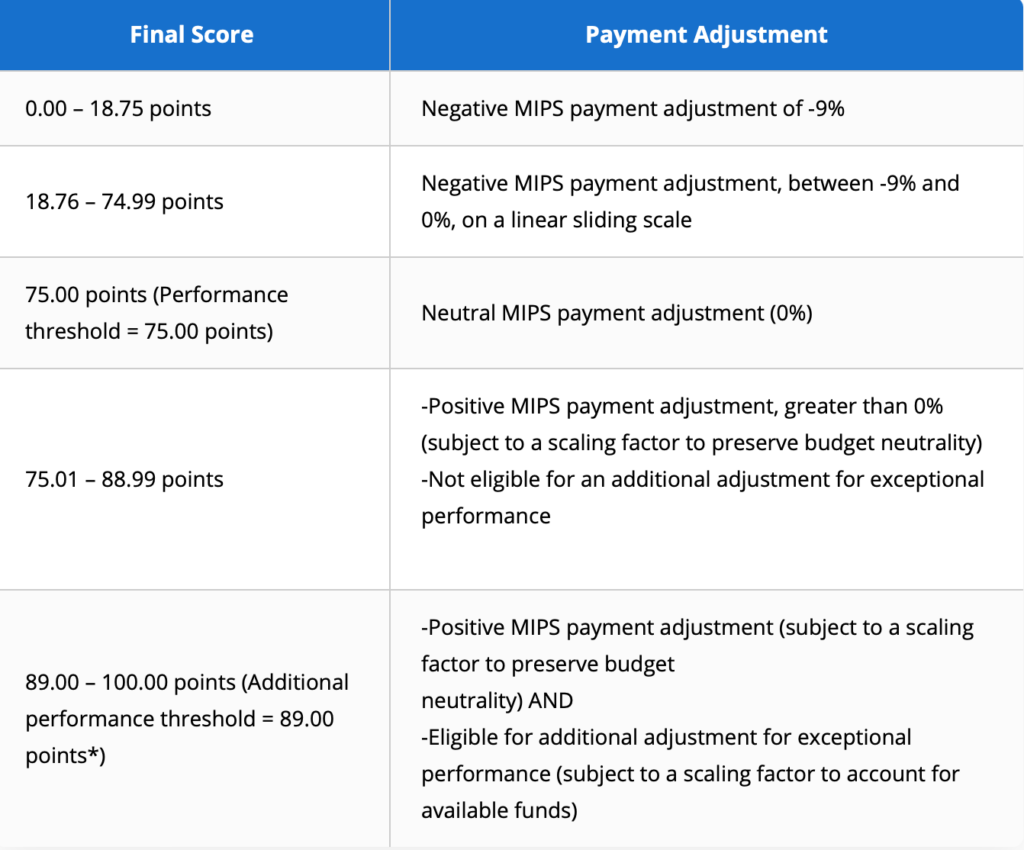

Your 2022 MIPS score affects your 2024 payment rate. To avoid a payment deduction in 2024, you need a 2022 score of 75 points or more. In 2024, adjustments are made to each Medicare payment for professional services based on this score. These adjustments apply to the amount paid by Medicare, not the “allowed amount.” Below is a table from MDInteractive.com showing how 2022 scores correlate with 2024 adjustments:

CMS has also estimated payment adjustments for 2024 based on PY22 Final Scores. Adjustments can range from –9% to +8.25% depending on your 2022 result, in which the median Final Score of 75 would yield a payment adjustment of 0%. This table estimates payment adjustments for 2024:

Impact of COVID-19 on 2023 MIPS

If you believe that your MIPS data was compromised due to COVID-19 or some other uncontrollable circumstance, CMS allows you to request performance category by applying for an Extreme or Uncontrollable Circumstance (EUC) Exception. CMS will review your data and either approve or deny your request at a later date, and data submission is not required for a category approved for reweighting. You can learn more about EUC exceptions from CMS, or from our previous blog post on the topic.

If you’d like more information about performance feedback, CMS provides resources and documents on their website, which you can access here.